Eligible claims that can be financed:

-

Motor Vehicle

accident -

Institutional

abuse -

Motorcycle

accidents -

Slip and

fall -

Wrongful

death -

Sexual

assault -

Sporting

injury -

Long term

disability -

Animal

attack

At CaseMark Financial,

we understand the difficulties caused by the litigation process, so our loans are designed to help you through this difficult time. We understand the financial pressures that arise from being involved in an accident or having your benefits terminated. Our settlement loans can offer you the peace of mind to focus on your rehabilitation while ensuring your lawyer has the necessary time to maximize your claim.

Our Process

Frequently Asked Questions:

What are Settlement Loans usually used for?

Most clients use these funds to help with daily living expenses, past due bills, , rent/mortgage payments and other financial obligations. We do not restrict how you use the funds, however we strongly discourage borrowing against your claim for discretionary purposes, such as vacations or big ticket items.

How long does it take to get a loan?

Once we receive the requested information from your lawyer, we can approve your loan within 24 hours. The funds are transferred directly into your bank account the same day that we receive the signed loan document.

What if I have previously declared bankruptcy?

If you have previously declared bankruptcy or are currently in the process, we are usually able to structure our loan in a way that will be beneficial to you and allow us to be repaid. Each case is evaluated independently and we encourage you to apply.

How much can I borrow?

We assess each file individually to ensure that the amount you borrow does not negatively affect the amount you receive when your case resolves. Our loans are intended to alleviate the financial pressures you have as a result of being injured and to allow your lawyer the time needed to fairly resolve your case.

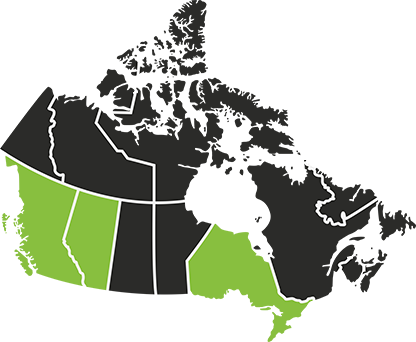

Happily helping people in the following regions!